A performance step utilized to examine the performance of an investment or to compare the performance of a number of various financial investments. Tyler T. Tysdal. ROI measures the amount of return on a financial investment relative to the financial investment’s cost. To determine ROI, the advantage (or return) of a financial investment is divided by the expense of the investment, and the result.

is expressed as a portion or a ratio( Source: Investopedia ). The process of pursuing ingenious market-based solutions to social issues while adopting a mission to develop and sustain social worth. An approach to handling money that provides a social dividend and a financial return. A financial investment method that seeks to consider both monetary return and social good; socially accountable investors motivate business practices that promote environmental stewardship, customer security, human rights, and diversity; likewise called sustainable, socially conscious,” green” or ethical investing. Impact investment is recording the growing attention of mainstream investors, and everybody is increasingly hearing and discussing it. During the previous 12 months, I have listened to people discuss impact investing more than in all the previous years integrated. Tyler T. Tysdal. Tyler Tivis Tysdal. There is a growing awareness and an emerging neighborhood in the UK and Europe, following on from the great work carried out in the United States up until now. In the next paragraphs, you will find a couple of key points, definitions and examples that can assist to begin understanding the idea and its appropriate significance in our everyday conversations, choices and actions. The main objective is to gain an initial view, find out about a few of individuals and business leading the market, and to share it with anybody that can take advantage of it. This is a section of financial investment that has actually been growing quickly, and the Global Impact Investors Network (GIIN) approximates from the latest annual survey that there is now in impact investing properties which is approximately double that of last year. Thomson Reuters Structure reported that members of Toniic, an international financial investment club for impact investors, have actually seen likewise spectacular growth with members.

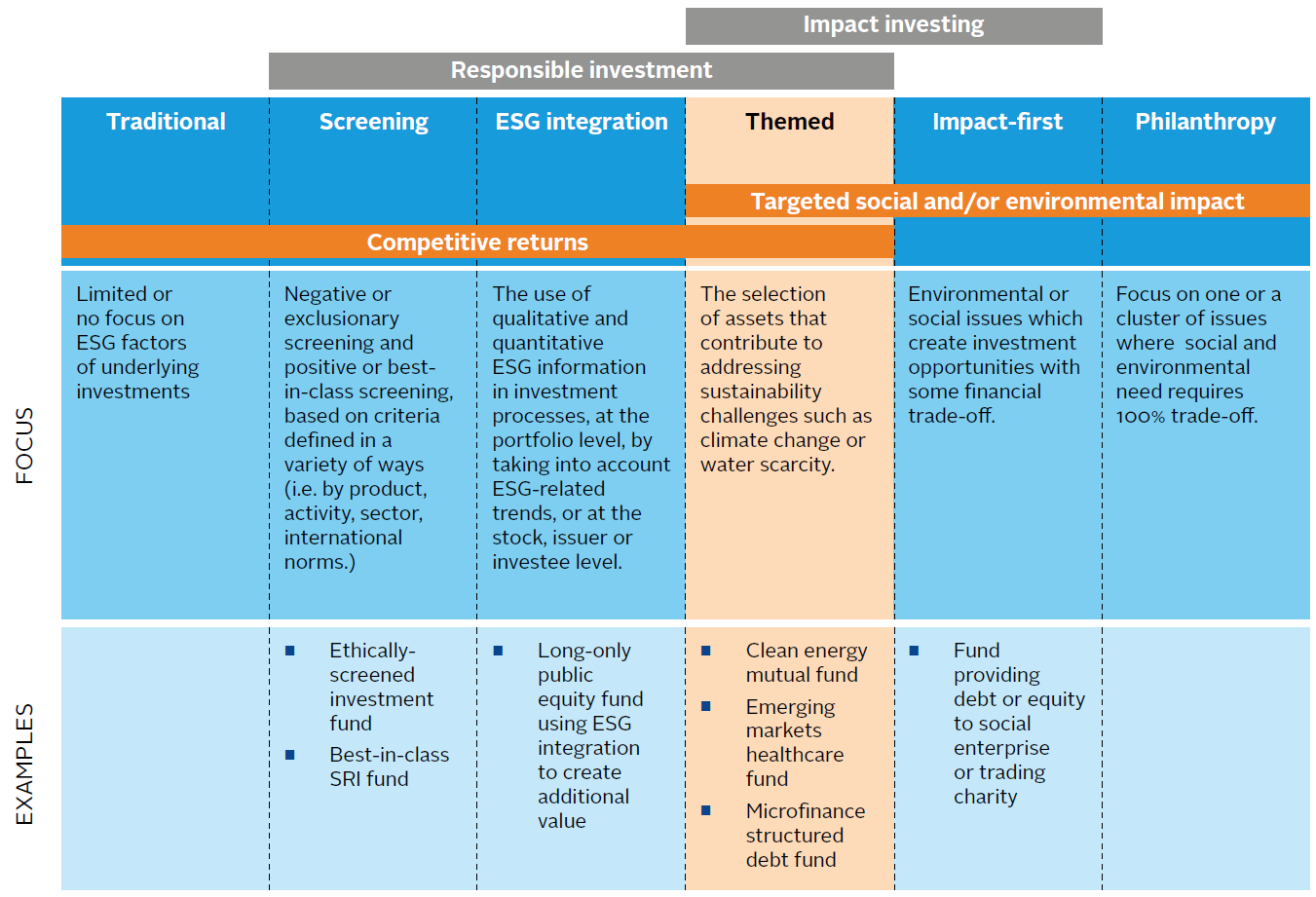

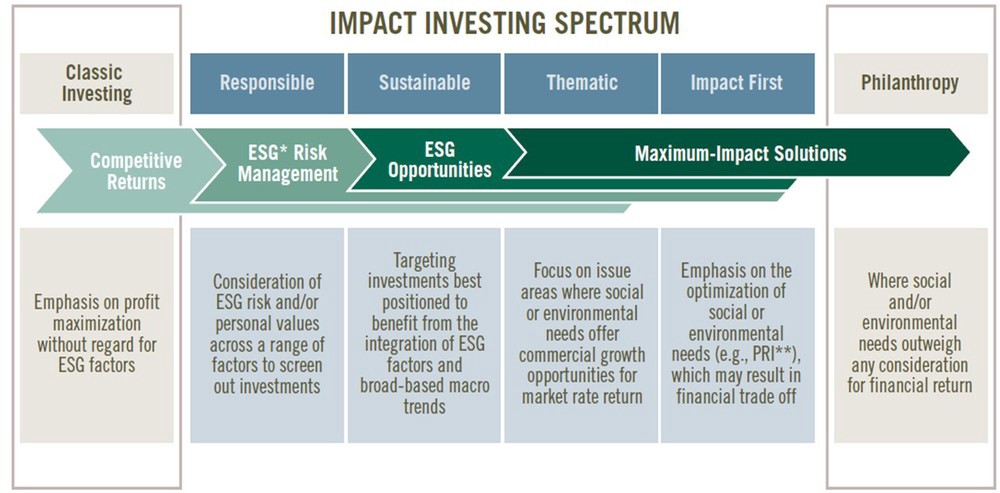

having their integrated of impact financial investments, which are up from $1.65 billion in 2016 (Tyler Tysdal Lone Tree). JP Morgan reported that impact financial investments, an emerging possession class, “uses the potential over the next 10 years for invested capital of$ 400 billion$ 1 trillion and profit of$ 183$ 667 billion” Alongside impact investing other similar ideas have evolved such as mindful industrialism, sustainable investment, and ethical investment. Socially accountable financial investment (SRI), which is a well-defined structure for selecting financial investments based.

on ecological, social and governance( ESG) requirements is not new to investors. The difference today is that impact investors are much more proactive in their objective for positive impact instead of merely preventing the negative impacts (Tyler Tivis Tysdal). As somebody who reads this, it may not surprise you that the world’s biggest international issue is now attracting impact investments. Tyler Tivis Tysdal. So what constitutes impact? There is a wide range of issue that requires addressing these consist of the social issues such as humanitarian crisis of refugees, relieving the impact from environment change-induced extreme weather condition events, decreasing air pollution in cities, resolving ocean plastics, changing our energy system to clean energy or sustainable ways of food production, to offering access to quality education and healthcare. These have actually assisted focus on what requires to be attained and determined in order to fix the world challenges. This is now galvanising the international effort in resolving the most significant challenges dealt with by humankind. For numerous Impact investors and funds, the 17 International Goals have actually ended up being a guideline for essential efficiency signs. As this Forbes explainer video programs, impact financial investment” integrates both the extensive analytics of conventional investment and the heart of philanthropy.” Given the severe obstacles, and in many cases permanent damage, that the world is dealing with, there is a long-lasting.

and essential shift in society with organisations now anticipated to do good and be purpose driven. Professional Photographer: Paul Hilton/Bloomberg News. BLOOMBERG NEWS Al Gore’s documentary, A Troublesome Truth, highlighted the ecological challenges we were facing more than 10 years ago – Tyler Tysdal Lone Tree. He didn’t stop there and went on to discovered Generation Financial investment Management in 2004 together with the head of Property Management at Goldman Sachs, David Blood,” To deliver remarkable investment efficiency by regularly taking a long-lasting view and completely integrating sustainability research within a rigorous framework of traditional monetary analysis. Among the challenges that well-intended funds like this one had actually been dealing with in the past was the lack of flow with size and scalability capacity, however this is currently altering. Quick forward to today, Blackrock, the world’s biggest investment firm handling over$ 6 trillion of possessions is telling business to consider their societal obligations. [+] Professional Photographer: Mark Kauzlarich/Bloomberg 2018 Bloomberg Finance LP “… society significantly is relying on the private sector and asking that business react to broader societal obstacles. Undoubtedly, the general public expectations of your business have never been greater. Society is requiring that business, both public and private, serve a social function.

Opportunities Fund Private

To succeed over time, every business should not just provide financial efficiency but also show how it makes a positive contribution to society. They went on to raise a record $471 million in 2016 for an impact fund that purchases cancer research initiatives and converts them into commercially successful businesses. The bank has committed to investing a minimum of$ 5 billion of personal client – Tyler Tivis Tysdal.

assets to Sustainable Advancement Goal-related impact investing, in a method that includes partnering with the Increase Fund a brand-new$ 2 billion social impact fund. Their white paper for the World Economic Forum yearly conference 2017 reveals a blueprint for funneling private wealth towards this. The follow-up report in 2018 shares 5 lessons to help bridge the$ 5-7 trillion financing space to attain the 17 International Objectives: Portfolios should think about including Multilateral Development Bank bonds. Financial companies need to interact to close the SDG-funding gap. Philanthropy is moving far from.

just offering money to more measurable approaches. Companies and social business owners must collaborate. For their efforts, actions and dedication, they have actually been called sustainability leaders in the Dow Jones Sustainability Index – Tyler Tysdal. If you are interested to find out how you can approach sustainable investing, according to James Gifford, UBS head of Impact Investing, there are three primary strategies: Exemptions ESG Integration Impact Investing There is a typical misunderstanding that a business that goes for the double bottom line of impact and monetary returns have lower returns. For instance, a 2015 study by Friede, Busch, and Bassen( ESG and Financial Performance: Aggregated Proof from more than 2,000 Empirical Studies, Journal of Sustainable Finance & Financial investment) found a non-negative relationship in between investing along ecological, social, and governance( ESG )aspects and corporate financial efficiency in around 90% of the more than 2,000 empirical studies conducted between 1970 and 2014. More of this to be covered in future short articles. Impact investing is here to stay and to grow tremendously over the next decade and beyond. It is basic, our future depends on it and people are understanding this at last (Tyler Tivis Tysdal). The humanitarian method of offering to charities is no longer the only way to make a difference and impact investing is now seen as a key driver for positive modification.