The Omnium1 is a modular system and might be upgraded any time. The Omnium1 prime was developed, engineered, and designed in Switzerland and is built on the well-identified and proven Android platform. There are two the reason why we predict that these merchandise are so good. However, in our humble opinion, do pay further cautious of any PEMF product’s helpful declare that is too good to be true or that sounds miraculous. Investing in a PEMF system is investing in your health. Many individuals have skilled pain relief through long term enhancements to their bone and joint well being. Some patients have reported spending hundreds of dollars only have their symptoms return after their therapy was concluded. Most PEMF techniques are fairly expensive, starting from 500-10 000 dollars. For more information visit us at iMRS2000

What does a PEMF machine do?

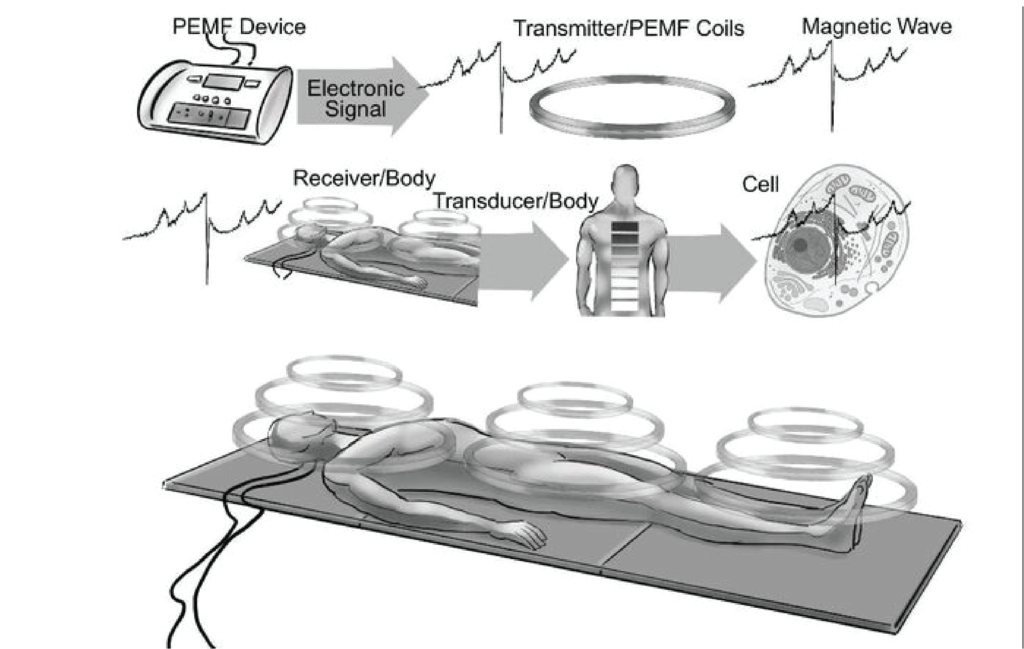

Please contact the PEMF Centre for worldwide courier prices. PEMF exercise instantly stimulates your brain leaving you feeling energized and centered. Low 30 min oscillating PEMF – Schumann frequency to cut back ache, regenerate bone density, strengthen the immune system, chill out and induce deep and energized sleep. I had talked to a number of people who had gotten Pulsed Electromagnetic Area (PEMF) therapy and had an idea of the way it labored. By inducing a mild electrical magnetic current into broken cells, PEMF therapy slows or stops the release of pain and inflammatory mediators, will increase blood flow of the cells, and re-establishes regular cell interaction. Read more: https://imrs2000.com/pemf-machine/

Utility of PEMF expertise may be as simple as localised ache relief, bone fracture recovery in clinical settings, improve blood (micro) circulation, and to a extra holistic complementary remedy for all form of alignments like most cancers, diabetic, osteoporosis, fibromyalgia, and many others. although extra research are wanted to verify the effectiveness of the respective treatments. The doctor will suggest a selected treatment plan that most closely fits your wants. There are a fantastic many issues and circumstances that might be positively affected by nearly any kind of magnetic field, no matter frequency, waveform, intensity, coil configuration, or slope of the magnetic pulse (slew fee). Go to our links web page to various researches, articles, and merchandise that can be useful in your understanding. Healthyline’s authentic products are known as Far Infrared Ray (FIR) mats.

As well as, these varied sized mats come in quite a lot of GEM stone mixtures. Come attempt it out your self to really feel the extraordinary benefits of the PEMF machine! In one other unbiased observation using human energy area evaluation, with Bio-properly reader, we are able to clearly see a considerable increase of energy subject throughout the physique after a quarter-hour session on a PEMF system. The second image reveals the body temperature increased by at the very least 1-2 Celsius after eight minutes of treatment, demonstrating the effectiveness of bettering blood circulation. The blood sample under is taken using darkish subject microscopy know-how exhibiting the blood cells condition earlier than and after the PEMF therapy. What PEMF does is shoot electromagnetic pulses into an space of your physique-any part you wish-that isn’t functioning correctly.

How much does a PEMF machine cost?

Smooth tissue injury is part and parcel of the life of a trainer. Dwelling-based mostly PEMF is basically a system where it is designed to generate a pulsing electromagnetic discipline at a really low frequency (1-100Hz often) which you place it towards half or whole of your body that wants the remedy. As a result of of these effects, PEMF is an efficient remedy for neuropathy. The result normally might be instantly felt by the particular person after utilizing the full-body PEMF therapy, with an increased dose of vitality and vitality. The result is a elementary, holistic wellness software that has a direct general optimistic effect on the organism (even if we don’t feel it instantly). Pulsed electromagnetic area therapy gives a number of well being advantages, including improved well being and wellness.

Throughout the late nineteenth and early twentieth century, many theories produced energy drugs devices, which have been promoted with out scientific proof and had a big selection of operating characteristics, together with heating tissue. In the case of bone healing, PEMF uses directed pulsed magnetic fields by way of injured tissue. For the reason that late 90’s, iMRS / MRS 2000 has been the leader in PEMF therapy. The precise software (therapy) used for the past 60 years in hospitals and in veterinary drugs consists of specific frequency patterns and really high intensities – these applications are limited to specifics treatments (i.e. acceleration of bone cell regeneration or healing for non-uniform fracture). The iMRS, or iMRS 2000, is the world leading PEMF therapy gadget for home use, based mostly on the culmination of greater than 20 years experience in vitality medication and with more than 4 billion in-house applications worldwide.

However, from clinical studies perspective, most standard practitioners still think there is an absence of sufficient research to support its vast applications apart from the extra widespread utility for pain relief, bone fracture restoration, and improving blood circulation. There occurred to be a local chiropractor who was utilizing the expertise in his follow. It is sometimes labeled as regenerative medication or energy drugs, relying on who you might be speaking to. Corticosteroid-Related Congestive Heart Failure in 12 Cats by Stephanie A. Smith, DVM, MS, DACVIM (Inside Drugs), Anthony H. Tobias, BVSc, PhD, DACVIM (Cardiology), Deborah M. Fantastic, DVM, MS, DACVIM (Cardiology), Kristin A. Jacob, DVM, DACVIM (Cardiology) & Trasida Ployngam, DVM.

Jade opens the center chakra which promotes love, compassion, forgiveness and trust. To show the efficacy and the impact it has on our physique, there are some technologies that we might utilize. Regardless of pulsed electromagnetic field (PEMF) can have significant effect on our trillions of cells, the effect normally shouldn’t be simply felt or pickup by our physique sensory techniques. With out getting into the technicality of the evidence, a common strategy in verifying the impact of PEMF (aside subjective feeling) can be achieve using blood analysis using darkfield microscopy, physique thermal imaging, and also a slightly extra controversial energy scanning.

Subscribe to our Youtube channel.

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)